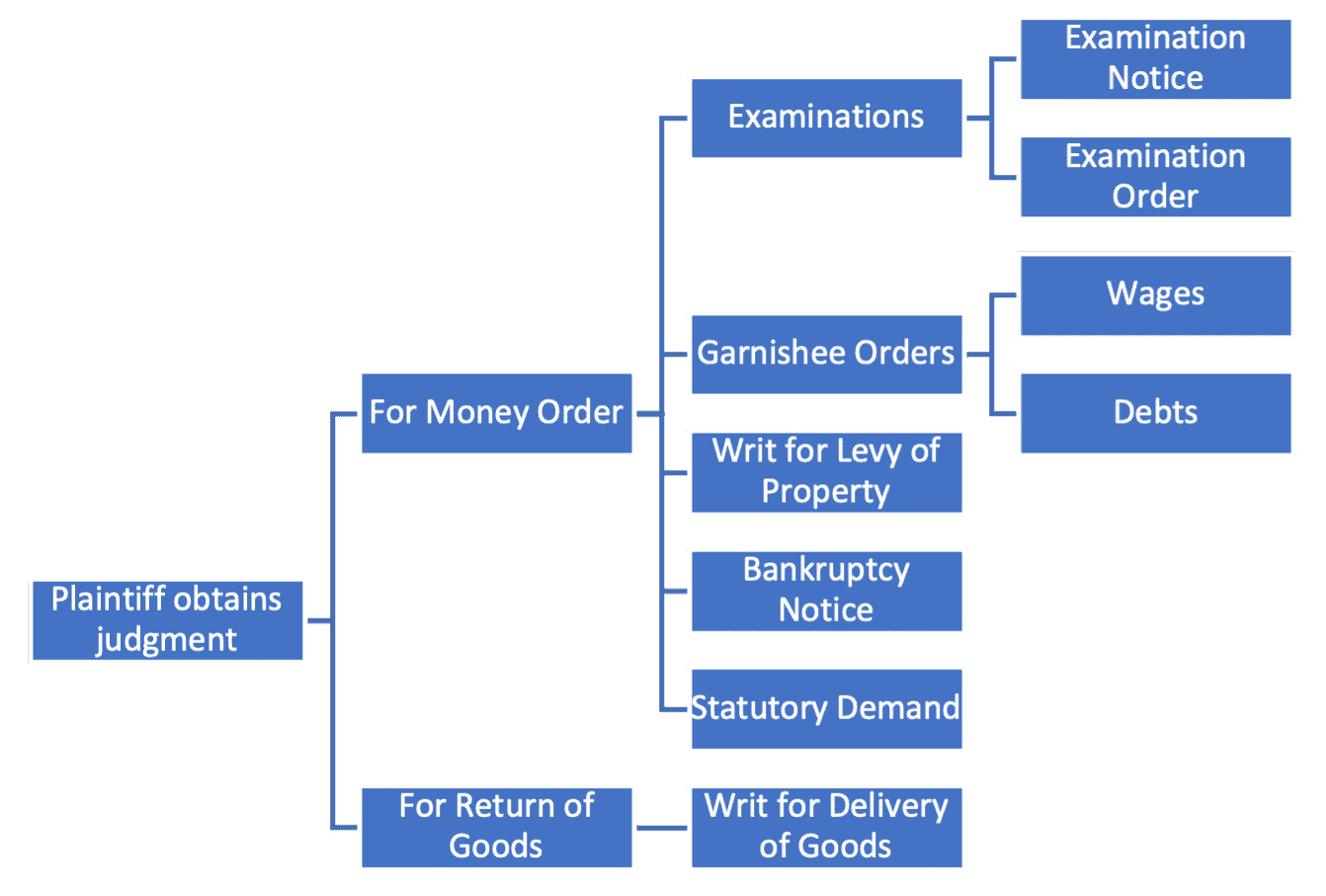

The aim of litigation through the courts to obtain confirmation of the outcome of a dispute in the form of a judgment. If you are the plaintiff in a civil money claim, you are likely targeting an order that the defendant pay you money or return your property. While obtaining that judgment is morally rewarding, making sure the defendant complies with the order will provide the ultimate satisfaction.

When the defendant to civil judgments doesn’t comply with the court’s orders, the plaintiff (now judgment creditor) has an arsenal of options to enforce that judgment. This article deals with the various options judgment creditors have in enforcing a judgment for money and the return of property.

WHERE YOU HAVE AN ORDER FOR PAYMENT OF MONEY

Examination of Judgment Debtor’s Income and Assets

The purpose of an examination is to establish what assets and liabilities the defendant possesses. In the first instance, a plaintiff can issue an examination notice to the defendant. An examination notice is a time sensitive document requiring the defendant to return a completed statement of their financial affairs, so the plaintiff can decide what method of enforcement they would like to use. For varying reasons, a defendant may choose not to reply or comply with the examination notice within the stipulated 28 days.

Failing a defendant’s response, a plaintiff can turn the court’s assistance for an examination order. It is considered a failure to respond if the defendant does not reply to your notice, partly fill out the notice but do not provide all information or give all information but no supporting documentation that you have requested.

Under an examination order, the defendant must present themselves in court, providing documents and answering material questions about their financial position. Material questions are defined as questions regarding the debt owing, what property or assets are owned by the defendant and any questions to aid in the enforcement or satisfaction of judgment orders.

Under an examination order, the defendant must present themselves in court, providing documents and answering material questions about their financial position. Material questions are defined as questions regarding the debt owing, what property or assets are owned by the defendant and any questions to aid in the enforcement or satisfaction of judgment orders.

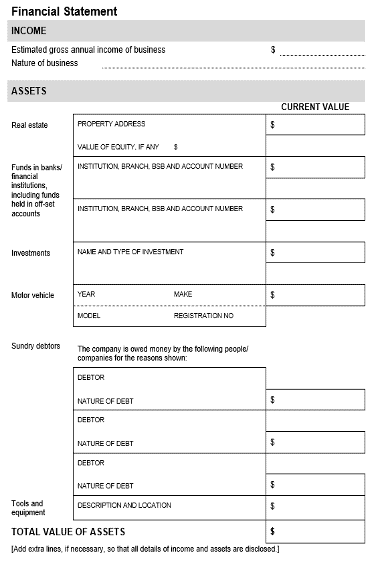

Assets and Liability Declaration

The assets and liability declaration form used in examination proceedings (example to side) requires the debtor to set out their assets and liabilities as at the time of completing the document. This, as suggested above, allows a plaintiff to determine the best form of enforcement on a judgment debt (we discuss those options below).

Garnishee Order for Debt or Wages

A garnishee order refers to an order made by the court allowing a plaintiff to garnish (recover) a judgment debt via any of the following avenues:

- the defendant’s wages;

- the defendant’s bank account; and/or

- someone else who owes money to the defendant.

The order is generally directed at and addressed to the financial institution, employer or debtor to the defendant, referred to as the ‘garnishee’.

Garnishee Order for Wages

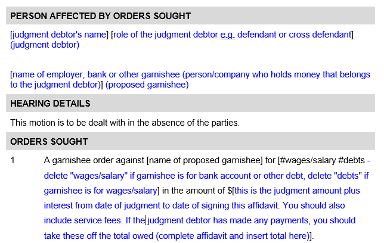

A garnishee order for wages, as suggested by the name, deducts a portion of the defendant’s wages in payment of the judgment debt, and continues until such time as the debt is paid in full. There is a mandatory threshold the employer is required to pay the defendant, referred to as the weekly compensation amount, representing the minimum amount determined that a person requires to live their everyday life. An example of a draft garnisheer order shown above.

A garnishee order for wages, as suggested by the name, deducts a portion of the defendant’s wages in payment of the judgment debt, and continues until such time as the debt is paid in full. There is a mandatory threshold the employer is required to pay the defendant, referred to as the weekly compensation amount, representing the minimum amount determined that a person requires to live their everyday life. An example of a draft garnisheer order shown above.

Garnishee Order for Debts

A garnishee order for debts will generally require concise information about either a defendant’s bank account or a debt owing to the defendant. A bank or person who is a garnishee is required to pay any amount or amount owing over the weekly compensation threshold, plus $20. This is to protect the livelihood of the defendant, similar to a garnishee order for wages.

If the bank balance or debt owing to the defendant does not cover the full judgment amount, a further garnishee order can be applied for at a later time.

Writ for the Levy of Property

A writ for levy of property is a writ that allows the Office of the Sheriff to attend a premise owned or connected to a defendant, for the purposes of seizing property for sale in satisfaction of a judgment debt. In other words, if you obtain judgment against a defendant who owns a vehicle, that vehicle may be seized and sold, with the net proceeds returned to you in reduction of the money you are owed.

The kind of property that can be seized includes any personal property or goods owned by the defendant, or money, cheques, bonds and securities. In some instances, you can claim land from a defendant, however the process has additional steps and is known as a “writ for execution for land”.

A writ for levy of property lasts up to 12 months but can be extended upon application for a new writ at expiry. A writ is seen as a cost-effective measure, given no filing fee is payable and poses the writ for levy of property of

Bankruptcy Notice

A bankruptcy notice is a formal damage against an individual to make payment for a final judgment or order. The judgment must be entered within the last 6 years and be more than $10,000 to be issued on the defendant.

Once a notice is issued, the defendant will have 21 days to comply from the date the notice is served. Service can be effected by personal delivery, post, courier, fax or email. Failing any of these five methods, an application can be made to court to order for substituted service – permission by the court to serve the bankruptcy notice in another fashion.

If the defendant fails to respond or comply with the notice, it is deemed an “act of bankruptcy”, and you, as a creditor, may then apply for a “creditor’s petition” with the Federal Court or Federal Circuit Court. Other acts of bankruptcy can be found under section 40 of the Bankruptcy Act 1966 (Cth) and include (but is not limited to) examples such as non-compliance with a bankruptcy notice, entering into a debt agreement proposal, or entering into a personal insolvency agreement. This application will request an order from the Court that the defendant be made bankrupt.

Statutory Demand

A statutory demand requests the winding up of a company if it fails to comply with the request in the demand form. Similar to a bankruptcy notice, the statutory demand is a formal request made by a creditor in writing to pay a debt within 21 days from the date of service. A statutory demand also has a dollar value threshold, like that of a bankruptcy notice, however the statutory demand must be for a debt greater than only $4,000.

The defendant, after being served with the statutory demand, may apply to have the statutory demand set aside, meaning the demand is cancelled, and can be for numerous reasons, including a disputed debt, an offset claim, a defect in the demand or some other reason.

If the defendant does not comply and fails to have the statutory demand set aside, it is considered a “presumption of insolvency”. A presumption of insolvency allows for a creditor to apply within three months from the failure to respond to the statutory demand, to apply for the defendant to be wound up, appointing a liquidator over the company to liquidate assets and payout creditors.

ENFORCING AN ORDER FOR THE RETURN OF PROPERTY

Writ for the Delivery of Goods

A judgment for the return of goods is as it suggests – that the defendant is in possession of goods owned by you and must return them. A writ for the delivery of goods is an enforcement method whereby the office of the sheriff is engaged for the purposes of seizing and returning the goods to you, or other assets that are of equal or lesser value and selling them in satisfaction of a judgment debt.

Enforcement Options for Plaintiffs obtaining Judgment

Rostron Carlyle Rojas Lawyers are skilled in the enforcement of judgment debts. Our dedicated litigation and debt recovery teams are on hand to assist you with taking the right steps toward achieving your desired results.

Contact our team at 02 9307 8900 or email [email protected] to speak with one of our lawyers today.

The blog published by Rostron Carlyle Rojas is intended as general information only and is no legal advice on any subject matter. By viewing the blog posts, the reader understands there is no solicitor-client relationship between the reader and the blog published. The blog should not be used as a substitute for legal advice from a legal practitioner, and readers are urged to consult RCR on any legal queries concerning a specific situation.