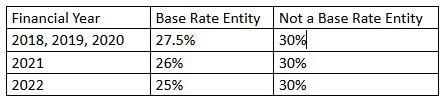

Changes to the tax laws commencing the 2018 financial year were introduced to provide tax relief to smaller companies. Instead of the blanket 30% corporate tax rate across all companies, the following rates apply:

A base rate entity is a company for which:

A base rate entity is a company for which:

- no more than 80% of its assessable income for the financial year is passive income; and

- aggregated turnover does not exceed:

- $25 million for the 2018 financial year;

- $50 million for any of the 2019 financial years onwards.

Included in the definition of passive income are corporate distributions (excluding non-portfolio dividends) and franking credits on those distributions, and any amount received from a trust to the extent that it is referable to passive income.

While the reduction in corporate tax rate provides welcome relief to small businesses operating out of corporate structures, there may be serious implications to franking accounts where a trading company was previously taxed at 30% but is subsequently regarded as a base rate entity.

It is common to structure ownership and operation of a business via a trading company in which the shares are held by a discretionary trust. One of the beneficiaries of the trust is a bucket company that receives income from the trust so that trust income is not taxed in the hands of the trustee at the highest marginal rate but at the lower corporate tax rate. If the bucket company has been receiving income franked to 30% and has accumulated significant franking credits at this rate but it then becomes a base rate entity, it can only frank dividends to the lower tax rate which may lead to an excess of unusable franking credits.

More seriously, the bucket company may be liable to pay top-up tax in the following scenario: The trading company is a base rate entity and pays a dividend to the trust franked at the lower rate. The trust distributes the dividend to the bucket company, but because the distribution came from a trust (and therefore the bucket company does not have at least a 10% voting interest in the trading company excluding it from the definition of “non-portfolio dividend”) the income will be deemed to be passive income and the bucket company will not be regarded as a base rate entity. As a result, the bucket company must pay tax at 30%.

It remains to be seen if the Department of the Treasury will address the indirect effects of the change to corporate tax rates on company franking accounts. In the short term, anyone using a bucket company to retain profits should carefully consider the effectiveness of the strategy in light of these changes.