The Federal Government of Australia wage subsidy scheme

30 March 2020

On 30 March 2020, the Australian Federal Cabinet met to announce its next tranche of financial stimulus in response to the Coronavirus pandemic. The key topic being the announcement of the Australian Job Keeper Allowance.

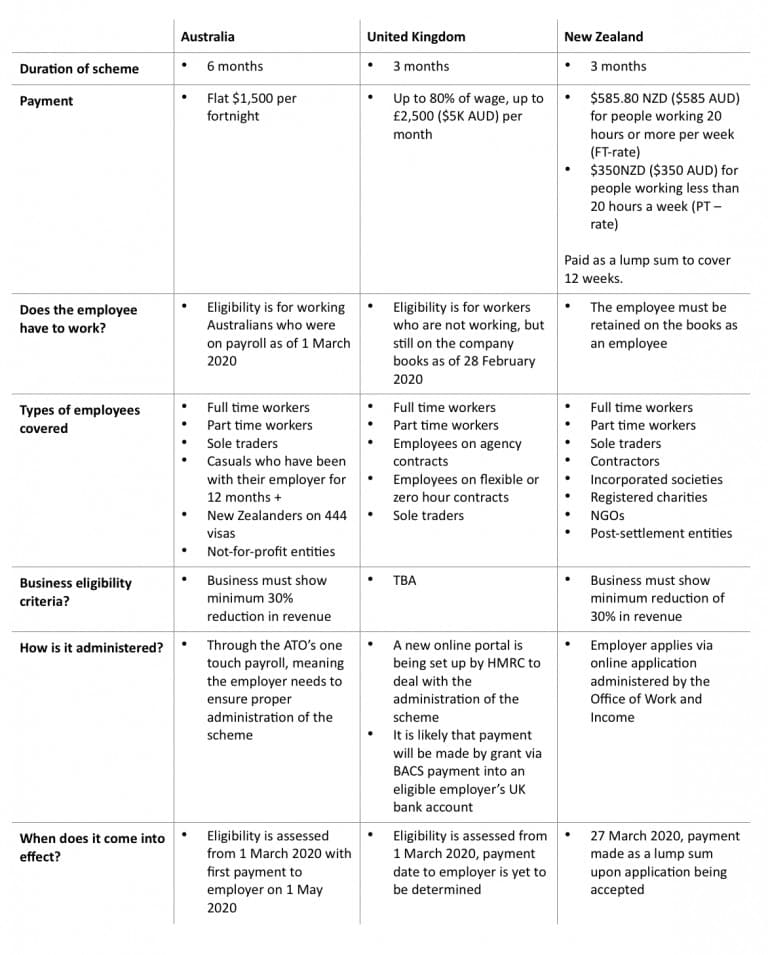

The Job Keeper Allowance has been developed by the Federal Government to help Australian businesses keep their Australian employees in their jobs, working. Under the scheme, eligible employees will receive Government support through their employers of $1,500 per fortnight. This is a flat payment scheme and is not means tested against the employee’s regular wage (as we have seen with similar schemes in other countries such as the UK).

To be eligible for the scheme, businesses will have to show that they have suffered a minimum reduction in revenue of 30%. This means a business has experienced a 30% decline in:

- Actual revenue; or

- Predicted revenue (e.g. for businesses who have seen a reduction in bookings such as accommodation providers).

The business decline can be demonstrated from 1 March 2020. We are yet to get details on how to determine the decline in revenue under the Australian scheme. We can however look to the New Zealand system which was announced on 26 March 2020 for guidance. Under that system:

- For businesses who have operated for more than a year:

The business should assess their revenue by comparing one month’s revenue against the same month the previous year (example February 2020 compared to February 2019). The revenue of the month in the affected period must be at least 30% less than it was in the month it was compared against.

- For businesses who have operated for less than a year:

The business must compare their revenue against a previous month that gives the best estimation of the revenue decline related to COVID-19 (Coronavirus).

The system will be administered through the ATO’s one touch payroll system. The credits for payment will be provided to the employer starting 1 May 2020. Until that time, employers should now assess their staff for eligibility under the scheme and make the proper elections to ensure credit will be provided on time. It is not up to the employee to sign up for the scheme, although it is recommended that employees speak with their employer about eligibility.

The Job Keeper allowance is not available to former employees of the company, if they were let go prior to 1 March 2020. If an employer wishes to re-hire an employee that they recently let-go (post 1 March 2020), they may be able to qualify that person for the scheme. According to PM Scott Morrison, if redundancy payments have been made to a recently made redundant employee, the employer and employee will need to discuss how to undo those arrangements themselves.

The underlying theme for the Job Keeper Allowance is that it is for just that, Australians who keep their jobs. If an employee is unable to keep their job, then they will be properly placed in the Job Seeker scheme. There is no doubling up of the two schemes.

We are yet to have news on what other Government schemes will be available to employees who receive the Job Keeper Scheme. For example, it is uncertain at this time if an employee on Job Keeper will be eligible to withdraw from their superannuation or seek rental assistance. We will keep you up to date on this as the legislation reaches Parliament.

How we compare to other nations- Coronavirus Wage Subsidies (Job Keeper Scheme)

The UK Coronavirus Job Retention Scheme

In the United Kingdom, the Coronavirus Job Retention Scheme will cover the cost of wages backdated to 1 March and is initially open for 3 months, and may be extended if necessary.

British workers who have been asked to stop working, but who are being kept on the pay roll, otherwise known as ‘furloughed workers’, will receive a subsidy of up to 80% of their wage, up to a value of £2,500 ($5K AUD) per month. This is a measure to safeguard against workers being made redundant.

Self-employed Brits receive a similar grant of 80% of their average profits from the past 3 months, up to a value of £2,500 ($5k AUD) per month. The financial support in the UK will not be available until mid-June.

The Australian Federal Government has commented that a system like that of the UK’s would be inequitable and difficult to administer within Australia’s social security system.

The New Zealand Coronavirus Wage Subsidy

In New Zealand, wage subsidies are being provided as a lump sum flat rate depending on the number of hours an employee works in a week. The NZ Government will subsidise full time workers (20+ hours per week) a flat amount of $585.80 per week; part time workers (-20 hours per week) will receive $350 per week. The subsidy is paid as a lump sum and covers 12 weeks per employee.

This system is similar to Australia in that it is for workers who continue to work. Other welfare systems are available to workers who are no longer gainfully employed.

Other eligibility criteria which is similar to Australia is that the business must be able to show a decline in revenue by minimum 30%. The decline must be due to the effects of COVID-19 and the business must show they took active steps to mitigate the loss (We are yet to see if these criteria will be included in Australia).

NZ employers are encouraged to pay at least 80% of their employee’s usual wages. If that isn’t possible, they must pay at least the subsidy rate. Unlike the Australian system, if an employee’s wages are less than the flat rate, then the employee should be paid the full amount of their normal wage (i.e. no free pay rise).

Keep posted on Australian employment laws with updates from Rostron Carlyle Rojas Lawyers

We are committed to keeping you up to date with the ever-evolving laws in Australia, especially during the course of the COVI-19 pandemic.

The Job Seeker Allowance is yet to be put before parliament and therefore the finer details of eligibility for each person and each business will need to be determined once the legislation reaches Royal Assent. At this time, we are told parliament will meet soon in a bid to fast-track these historic changes.

Also read : Jobkeeper Payment Scheme- recent update