In September 2019, our article – What is a director penalty notice and what does it mean for you as a director?, touched on when a director(s) may become personally liable for two types of tax debts of a limited company namely, Pay As You Go (PAYG) and Superannuation Guarantee Charge (SGC) liabilities.

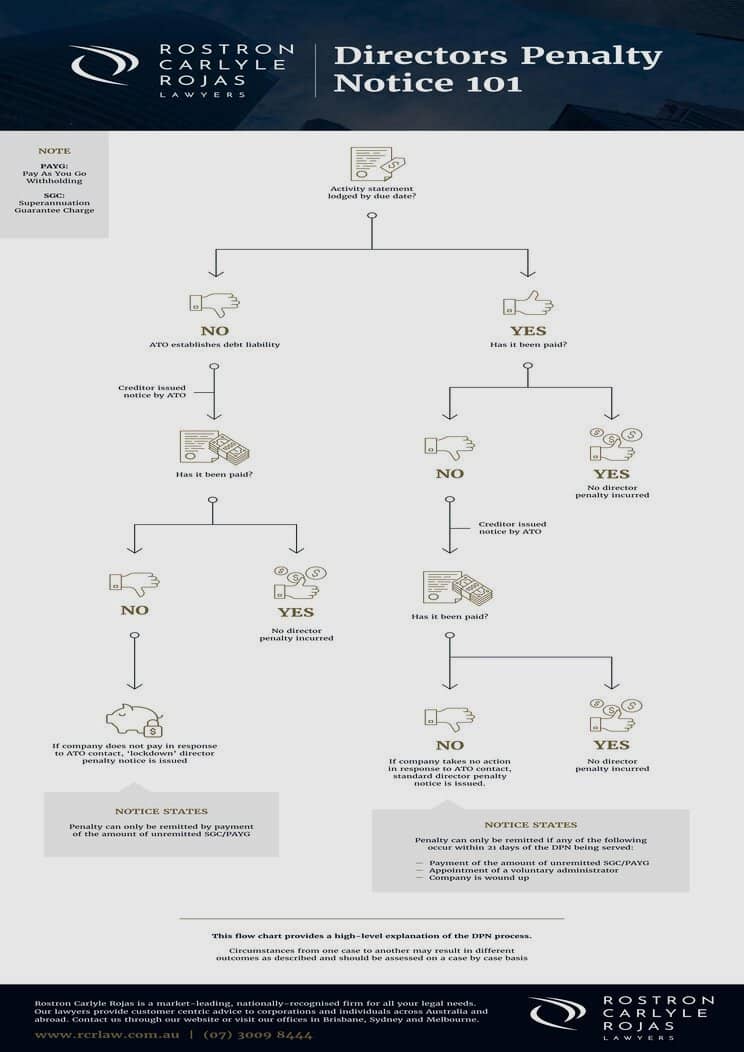

(Below is a Director’s Penalty Notice 101 to get you up to speed with Director penalty notices before you read the update).

Director’s Penalty Notice 101 Infograhic

Fast forward to 2020, and the Treasury Laws Amendment (Combating Illegal Phoenixing) Bill 2019 (the Bill) has been passed to include penalties for unpaid Goods and Services Tax (GST), Wine Equalisation Tax (WET) and Luxury Car Tax (LCT). The Bill provides that any assessed net amount or GST instalment will necessarily include any applicable LCT and WET.

The new provisions to include director penalties for GST apply from 1 April 2020.

So how does the Bill affect you under the Director Penalty Notice regime and what can you do about it?

1. SGC and PAYG (Pay As You Go) Liabilities

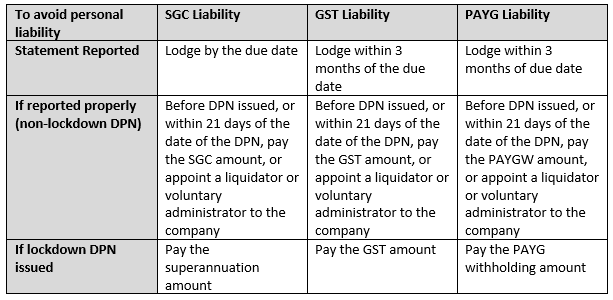

With respect to Super Guarantee Charge (SGC) liabilities, for a director penalty to be eligible to be remitted without payment, the unpaid amounts of superannuation must have been reported by lodgement of the SGC statement by the due date.

For the Pay As You Go amounts that a company must withhold from wage payments made to employees for remission to the ATO (Australian Tax Office), the PAYG withholding must be reported within 3 months of the due date for a director penalty to be eligible to be remitted without payment.

If the SGC statement was not reported by the due date, or the PAYG withholding was not reported within 3 months of the due date, the ATO can issue a ‘lockdown’ Director Penalty Notice and a director can only avoid liability under the DPN (Director Penalty Notice) by arranging for those liabilities to be paid. Appointing a liquidator or voluntary administrator to a company will not avoid liability for lockdown Director Penalty Notice amounts, and the ATO can:

• Issue lockdown DPNs after a company is placed in liquidation or voluntary administration; and

• If necessary, base lockdown DPNs on estimates of a company’s superannuation or PAYG liability.

However, if the SGC was reported by the due date and the PAYG withholding was reported within 3 months of the due date, then a director can avoid personal liability by appointing a liquidator or voluntary administrator to a company. This must be done either before a DPN is issued or within 21 days of the date of the DPN.

2. (Goods and Services Tax) GST Liabilities

With respect to GST liabilities, if a company has failed to pay Goods and Services Tax and also failed to lodge its Business Activity Statements (BAS) within three months of being due, the directors will automatically become personally liable for unpaid GST. Accordingly, the ATO (Australian Tax Office) may issue a lockdown Director Penalty Notice for the Goods and Services Tax liability.

However, if a director is in the position where:

1. the company has failed to pay GST (Goods and Services Tax);

2. the ATO has issued a 21 day Director Penalty Notice; but

3. the company lodged its BAS within three months of the due date,

the director will have 21 days from the date of the notice to exercise one of three options to avoid personal liability. The options are:

1. paying the GST to the ATO;

2. placing the company into liquidation; or

3. placing the company in voluntary administration.

Exercising one of the above options within 21 days will allow a director to avoid personal liability and the debt remains with the company.

What you should watch out for

Ideally, to avoid DPN liability, a company or its director(s) must pay PAYG, superannuation, GST, Wine Equalisation Tax and LCT liabilities on time.

If you are a new director be wary that you can be made liable for historic GST, PAYG and SGC where these remain unpaid 30 days after your appointment. Therefore, when being newly appointed as a director, be careful to ensure you are not inheriting those liabilities.

Summary of notice periods to avoid liability

Coronavirus

In consideration of the current impacts of COVID-19 (Coronavirus), it is unclear whether the ATO will extend the due dates discussed above.

However, the Coronavirus Economic Response Package Omnibus Bill 2020, now Act No 22 of 2020 following its assent on 24 March 2020, may exempt those affected by COVID-19 from these obligations.

Schedule 8 of the Coronavirus Economic Response Package Omnibus Bill 2020 provides flexibility by establishing temporary means through which individuals who are unable to meet their obligations under the Corporations Act or the Corporations Regulations (due to COVID-19) can access regulatory relief for a maximum of six months. In particular, the Treasurer may determine:

• Exemptions from obligations; and

• Modifications of obligations to enable compliance.

As the Coronavirus situation continues to rapidly evolve, the aforesaid due dates may be subject to change, notwithstanding the new Coronavirus legislation. As always, we will continue to keep you updated. If you require any further information on this in the meantime, do not hesitate to contact us.