New thresholds for definition of ‘large proprietary company’ mean your business may no longer be required to lodge audited financial reports with ASIC each year.

As of 1 July 2019, the Corporations Amendment (Proprietary Company Thresholds) Regulations 2019 (Cth) came into effect. This amendment to the Corporations Act 2001 (Cth) doubles the existing thresholds for determining whether a company is a large or small proprietary company for a financial year.

This change has reduced the financial reporting obligations and costs for many companies that now fall into the smaller proprietary company threshold, as instead of having to file financial, director’s and auditor’s reports to ASIC as large proprietary companies do, they will only be required to keep written financial records for each financial year.

New thresholds

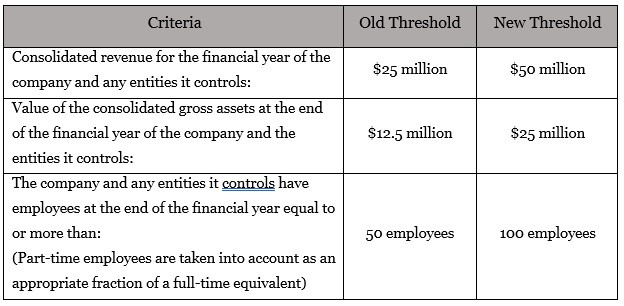

Under the new amendments, a company will be a large proprietary company for a financial year if it satisfies two of the following criteria listed in the table below:

Similarly, the requirements to be considered a small proprietary company are simply if the company does not reach two of the three of the above thresholds.

What this means for you

As mentioned above, the reporting requirements for each financial year are significantly different between large and small proprietary companies. Companies deemed to be large proprietary companies must lodge financial, director’s and auditor’s reports at the end of each financial year, as well as maintaining a whistleblower policy. Preparing these reports takes time and money, and failing to lodge them results in penalties on the company and sometimes even its officers, so removing the necessity to prepare them is great in regards to saving time, money and effort.

Furthermore, these reports become publicly available after being lodged with ASIC. The effect being that other businesses and prospective customers can freely access your financial information, which can potentially lead to market disadvantages or loss of business. Being able to avoid the reporting requirements is a great advantage to small proprietary business.

Conclusion and recommendations

The Treasury released estimates that after these changes approximately one-third of proprietary companies that submitted audited financial reports to ASIC for the 2017-18 financial year will not be required to lodge financial reports for the 2019-20 financial year under the increased thresholds.

If you are a business owner that has been over the threshold for the large proprietary company criteria for previous financial years, we certainly recommend that you take full advantage of these changes and see if your company can now be reclassified as a small proprietary company. The financial, time and effort advantages gained by these changes can be huge, especially with respect to keeping your company’s private financial information out of the public domain.